Thursday, June 29, 2006

Dollars, Dollars, Everywhere, and Not a One Worth Squat

Recall the hullabaloo resulting from Iran's announcement last summer that they were going to start an Iranian oil bourse (exchange) to conduct oil trade in Euros instead of US Dollars.

Iraq had infamously done this before and had suffered invasion. The conquering US immediately reversed the Iraqi policy.

The fate of the Iranian oil bourse became unclear as deadlines passed and contradictory statements were made. The threat seemed to lose its potency and the issue faded back into the desert sands.

Now comes Bush's soul mate Putin ("I looked into his eyes and saw his soul" to paraphrase Bush the seer) with a similar concept and the power to pull it off.

It is critical to American hegemony for the USD to remain the petro-dollar. A petro-ruble or a petro-euro would not do. Although I have seen some discussion of how devastating this change would be for the US, the consensus seems to be that the War in Iraq was launched in part to prevent the potentially devastating demise of the petro-dollar.

But boy-howdy, it looks like that former KGB soul mate may be on his way to creating competition for the Almighty (world reserve currency) Dollar.

Mike Whitney reports:

"On May 10, Russian President Vladimir Putin ignited a firestorm that is bound to sweep across the global economy. In his State of the Nation speech to parliament,, he announced that Russia was planning to make the ruble internationally convertible so that it could be used in oil and natural gas transactions. Presently, oil is denominated exclusively in dollars and sold through the New York Mercantile Exchange (NYMX) or the London Petroleum Exchange (LPE) both owned by American investors. If Russia proceeds with its plan, the ruble will go nose to nose with the dollar on the open market sending several billions of surplus greenbacks back to the United States. This could potentially send the American economy into freefall; triggering a deep recession and an extended period of hyper-inflation.

Currently, the central banks around the world carry large stockpiles of dollars to use in their purchases of oil. This gives the US a virtual monopoly on oil transactions. It also forces reluctant nations to continue using the dollar even though it is currently underwritten by $8.4 trillion national debt.

Putin's plan is similar to that of Iran, which announced that it would open an oil-bourse (oil exchange) on Kish Island in two months. The bourse would allow oil transactions to be made in petro-euros, thus discarding the dollar. The Bush administration's belligerence has intensified considerably since Iran made its intentions clear. In fact, just yesterday, Secretary of State Condi Rice said that "security guarantees were not on the table" regardless of any Iranian commitment to stop enriching uranium. In other words, Washington will not provide Iran a non-aggression pact whether it follows UN Security Council guidelines or not.

Surely, this is a sign that Uncle Sam is on a fast-track to war. (Empahsis mine.)

The United States must protect its dollar-monopoly in the oil trade or it will lose the advantage of being the world's reserve currency. As the reserve currency, the US can maintain its towering $8.4 trillion national debt and $800 billion trade deficit without fear of soaring interest rates or hyper-inflation. Trillions of greenbacks are constantly circulating in oil transactions just as hundreds of billions are stockpiled in foreign banks. In effect, the Federal Reserve is issuing bad checks with every dollar printed on the assumption that they will never reach the bank for collection. So far, they've been right, and as the price of oil continues to skyrocket, the Fed just keeps cheerily printing more worthless paper sending it to the 4 corners of the earth. Regrettably, if Russia or Iran goes ahead with their conversion plan, then the bad checks will flood back to their source and precipitate a meltdown.

America's economic supremacy depends entirely on its ability to compel nations to make their energy acquisitions in greenbacks. If the flaccid dollar is not linked to the world's most vital resource, then banks will dump it overnight. This extortion-racket is the system we are defending in Iraq, not democracy. It is a huckster's scam designed to perpetuate American debt by forcing worthless currency on the developing world.

In a recent article by Dave Kimble, “Collapse of the petrodollar looming", the author provides the details of Russia’s importance to the world oil market.

“Russia's oil exports represent 15.2% of the world's export trade in oil, making it a much more significant player than Iran, with 5.8% of export volumes. Russia also produces 25.8% of the world's gas exports, while Iran is still only entering this market as an exporter. Venezuela has 5.4% of the export market.

Obviously, it is not in Russia’s interest to trade with its European partners in dollars any more than it would be for the US to trade with Canada in rubles. Putin can strengthen the Russian economy and improve Russia’s prestige in the world as an energy superpower by transitioning to rubles. But, will Washington allow him to succeed?

A growing number of nations are now focusing on the empire’s Achilles’ heel, the dollar. Venezuela, Russia, Norway and Iran are all threatening to move away from the greenback. Is this a spontaneous uprising or is it a new type of asymmetrical warfare?

Whatever it is, Washington is bound to be reeling from the affects. After all, war maybe possible with Iran or Venezuela, but what about Russia? Would Bush be stupid enough to risk nuclear Armageddon to protect the drooping dollar?

The administration is exploring all of its options and is developing a strategy to crush Putin’s rebellion. (This may explain why Newsweek editor and undeclared spokesman for the Council on Foreign Relations (CFR), Fareed Zacharia, asked his guest on this week’s “Foreign Exchange” whether he thought Putin could be “assassinated?!? Hmmm? I wonder if we’ll hear similar sentiments from Tom Friedman this week?)

The Council on Foreign Relations (CFR), the secretive organization of 4,400 American elites from industry, finance, politics, media and the military (who operate the machinery of state behind the mask of democracy) has already issued a tersely worded attack on Putin (“Russia’ Wrong Direction; Manila Times) outlining what is expected for Russia to conform to American standards of conduct. The missive says that Russia is headed in “the wrong direction and that “a strategic partnership no longer seems possible. The article reiterates the usual canards that Putin is becoming more “authoritarian” and “presiding over the rollback of Russian democracy”. (No mention of flourishing democracy in Saudi Arabia or Uzbekistan?) The CFR cites Putin’s resistance to “US and NATO military access to Central Asian bases (which are a dagger put to Moscow’s throat) the banishing of Washington’s “regime change NGOs from operating freely in Russia (“Freedom Support Act funds) and Russia’s continued support for Iran’s “peaceful development of nuclear energy”.

America has never been a friend to Russia. It took full advantage of the confusion following the fall of the Soviet Union and used it to apply its neoliberal policies which destroyed the ruble, crushed the economy, and transferred the vast resources of the state to a handful of corrupt oligarchs. Putin single-handedly, put Russia back on solid footing; taking back Yukos from the venal Khordukovsky and addressing the pressing issues of unemployment and poverty-reduction. He is a fierce nationalist who enjoys a 72% approval rating and does not need the advice of the Bush administration or the CFR on the best path forward for his country.

The US has purposely strained relations with Russia by putting more military bases in Central Asia, feeding the turmoil in Chechnya, isolating Russia from its European neighbors, and directly intervening in its elections.

When the G-8 summit takes place next week, we should expect a full-throated attack from the corporate media on Putin as the latest incarnation of Adolph Hitler. Watch the fur fly as the forth estate descends on its newest victim like feral hounds to carrion. (Putin’s announcement that Russia would be converting to rubles HAS NOT APPEARED IN ANY WESTERN MEDIA. Like the Downing Street Memo, the firebombing of Falluja, or the “rigged 2004 elections, the western “free press scrupulously avoids any topic that may shed light on the real machinations of the US government)

Putin’s challenge to the dollar is the first salvo in a guerilla war that will end with the crash of the greenback and the restoration of parity among the nations of the world. It represents a tacit rejection of a system that requires coercion, torture and endless war to uphold its global dominance. When the dollar begins its inevitable decline, the global-economic paradigm will shift, the American war machine will grind to a halt, and the soldiers will come home. Maybe, then we can rebuild the republic according to the lost values of human rights and the rule of law. Putin’s plan is set to go into effect on July 1, 2006.

On a different topic:

I hope you've been taking advantage of the "correction" in the price of gold and silver to fortify your holdings. For you procrastinators, there is still time as the precious metals slowly climb back (and will soon surpass their former highs).

Wednesday, June 21, 2006

You Will Start Watching YouTube

Back in the '70's I used to teach film and video at the Western States Film Institute. I was always yakking about the coming digital revolution - that some day "real soon" people would be picking up their own cameras and creating meaningful content. That day has come. (I really didn't think it would take 30 years.)

YouTube.com has become the de facto repository for such efforts. Over 6000 videos are being uploaded there every day. Google tried with Google Video, but the interface (special viewer) and posting requirement were onerous. YouTube even went a step further and enabled embedding of linking code in other sites. Kinda viral, and very brilliant.

At first the YouTube postings were real lame. Soulful kids in front of their webcams being all emo and stuff. Weird dog clips. Hurtful boarder accidents. Lots of Japanese anime. Some pure junk.

But now creative good stuff is beginning to emerge. Remember the "desktop publishing" revolution that produced at ton of crap at first, then gave way to talent and creativity? This new "video publishing" revolution is going through the same unfolding.

Interesting features at YouTube include near instantaneous posting - without review. (Google's review took days.) The poster is responsible for the content and the copyright considerations. They also have a built-in rating system and view counter. Easy to find the good stuff that's bubbling to the surface. Professional producers and directors are using it for exposure. Even good ads make it to the top.

And this is no small audience. A recent comic vidi (my term for these short videos, borrowed from "A Clockwork Orange") entitled "The Evolution of Dance" has been viewed 25,325,048 times so far.

Recently I saw a broadcast TV executive make a bold prediction that "it would be a long time before people are watching TV on their computers." Harharhar. These guys are so dumb. Like the music "industry", they are stuck in yesterday while the streaming broadband internet leaves them behind.

YouTube is the embodiment of Web 2.0. User created content, viral distribution, no impediments to ease of use... just slick, damn slick.

I'll be "embedding" some of the better vidies that I find on this site, as a respite from the usual topics of gloom and doom. Hope you enjoy them.

Monday, June 19, 2006

This Really Works

You've probably been spammed more than once with bogus invitations to "make money on the internet - earn money online by taking surveys." Yeah, sure.

But, there is one that really works. I know because I've signed up and earned $108 so far. Not a huge amount, but nonetheless a steady stream. Once registered, and once you have taken their introductory survey, you will receive occasional invitations to take a particular survey. After answering a few qualify questions, you take a short (sometimes as much as 15 minutes) survey about telecommunications or other retail products. You will not be spammed as a result of your survey taking, and I've detected no misuse of email addresses or other bothersome side effects.

Some surveys will add $10 to your account. Others as little as $2 or as much as $50. Even if you do not qualify for a particular survey, you will be placed in a pool for a chance to receive a random "prize" of $10. An additional benefit is that if you sign up others, you continue to benefit when they complete surveys. For example, if you follow this link, and sign up, I will receive $2 every time you take a survey. You can do the same, add referrals, and make more money when they take surveys.

Soooo, try it out, and make money taking surveys online. For real.

Friday, June 16, 2006

Fresh Analysis of Peak Oil and Declining Dollar

Thursday, June 15, 2006

Continental United States

Remember my fantasy from the 1970’s that Canada, the USA and Mexico should form one big collection of States into The USNA? Well, others seem to be working on that idea. Check out the new vertical transcontinental highway which appears to be going to be built across your country. How many illegal aliens can you fit into an 18-wheel container?

Tuesday, June 06, 2006

Saturday, June 03, 2006

Back in Time

Sometimes you have to repeat yourself.

Some of my friends, including the guy who said this blog was "nothing but bad news that I can't do anything about”, are now asking, "Okay, suppose you are right, what am I supposed to do?"

1. Start reading. Educate yourself with Google. Subscribe to newsletters and news feeds. I strongly recommend that you get “The Daily Reckoning”. I’ve been reading it for years and I think the contributors are very perceptive. I fact, I just signed up for Doug Casey’s newsletter on gold and silver investing.

2. Buy some CEF stock. This Canadian company does nothing but hold gold and silver. You own the stock, not the metal. Check its trend and buy if it dips.

3. Buy GLD stock. This is a fund that tracks the exact price of gold - each share = 1/10 of the price of an oz. of gold. Buy SLV stock - each share = 10 oz. of silver.

4. Buy some gold or silver Eagles – 1 oz coins produced by our Mint. Very beautiful. Go to your local coin dealer - in Denver that would be Rocky Mountain Coin on Broadway. If you don't have a local coin dealer you can do it all on the internet, phone and mail. Go to http://www.kitco.com/. Put them in a safe, or safe deposit box (but be mindful of the previous confiscations).

And speaking of educating yourself - start by clicking on the movie below - very easy to take explanation of how and why you are getting screwed every minute of every day (maybe that could explain your crankiness lately) by the so-called FED.

Tuesday, May 30, 2006

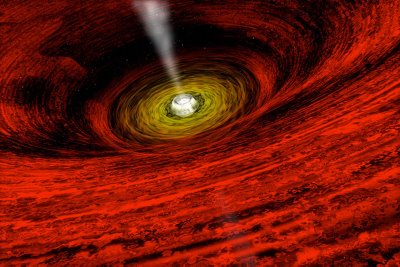

Eye of the Beast

Sometimes I just can't resist this stuff from NASA.

Sometimes I just can't resist this stuff from NASA.In the center of a swirling whirlpool of hot gas is likely a beast that has never been seen directly: a black hole. Studies of the bright light emitted by the swirling gas frequently indicate not only that a black hole is present, but also likely attributes. The gas surrounding GRO J1655-40, for example, has been found to display an unusual flickering at a rate of 450 times a second. Given a previous mass estimate for the central object of seven times the mass of our Sun, the rate of the fast flickering can be explained by a black hole that is rotating very rapidly. What physical mechanisms actually cause the flickering -- and a slower quasi-periodic oscillation (QPO) -- in accretion disks surrounding black holes and neutron stars remains a topic of much research.

Monday, May 29, 2006

More Maher

If, like me, you suffer when the Bill Maher season ends on HBO, you will rejoice when you discover a new venue featuring new Maher - Amazon.com's Fishbowl - true Internet TV. (And to think, I just heard a TV executive say last night that it would be a long time before people started viewing TV on the Internet.) Go here and enjoy Bill's latest endeavor.

P.S. Don't be confused when the viewer restarts. Its another segment being downloaded.

Sunday, May 28, 2006

United States of North America

Those of you who have read this blog from the beginning (harhar) may remember one of my first blogs, proposing that the US "convince" Canada and Mexico join their states with ours to expand the Republic.

Now I've run accross this report which reveals that this is the plan currently being followed by the three countries. Imagine my dismay when I finished reading the article and found it was written by one of the Swifties (Kerry attackers). Oh well, maybe I'm really a rightwingnut.

"What is the plan? Simple, erase the borders. The plan is contained in a "Security and Prosperity Partnership of North America" little noticed when President Bush and President Fox created it in March 2005:

In March 2005, the leaders of Canada, Mexico, and the United States adopted a Security and Prosperity Partnership of North America (SPP), establishing ministerial-level working groups to address key security and economic issues facing North America and setting a short deadline for reporting progress back to their governments. President Bush described the significance of the SPP as putting forward a common commitment "to markets and democracy, freedom and trade, and mutual prosperity and security." (Read entire article ...)

Friday, May 26, 2006

Fire in the Theater

from Richard Benson

FMNN Market Trends Strategist Publisher

Benson's Economic and Market Trends

"In order to fully understand what is really happening on the central bank front, Larry Summers is worth listening to, now that he is free of all the politics at Harvard. Mr. Summers who served in a series of senior policy positions – most notably as the secretary of the treasury of the United States – specialized in the currency markets. Indeed, he was “the man” who successfully engineered foreign central bank gold sales to help hold the price of gold down and make the dollar look strong!

Mr. Summers is now urging the poorer, smaller countries with excess dollar reserves, “to do something with them”. Perhaps his advice is to sanction foreign aid, but I suspect he may be encouraging these smaller central banks to swap out of dollars early before the big banks do. This would preserve the real value of their foreign exchange reserves, and save the IMF a lot of money down the road for not having to bail them out.

Just remember, when someone yells fire in the movie theatre, you want to be sitting in the back row near the exit door, so you can get out before it’s too late. Larry Summers has just yelled “fire”.

The dollar is in grave danger because there are hundreds of billions of dollar assets funded by hedge funds that will be sold. Worldwide, central banks are beginning to buy fewer dollars at a time when the U.S. needs new buyers of dollar assets to fund our escalating trade deficit.

If America, as a matter of policy, is going to let the dollar go, there are many investments you must not own as an investor or saver: One investment is dollar-denominated bonds. A falling dollar is very inflationary. As inflation rises, it forces interest rates up so you’ll lose on the currency devaluation, as well. U.S. Stocks will fight the headwinds of inflation and may go up in dollar terms, but they will most likely not keep pace with inflation." (read entire article...)

Thursday, May 25, 2006

Those Pesky Petrodollars Again

How much longer can the dollar reign supreme?

By Linda S. Heard

Online Journal Contributing Writer

May 25, 2006

Saddam Hussein stopped trading his oil for dollars before Iraq was invaded. Iran gets set to open a new oil bourse and futures market that will trade in euros, while Venezuela is said to be mulling over whether to follow suit.

Now Russia has joined the bandwagon. On May 10, President Vladimir Putin announced the creation of a Russian oil and gas bourse along with his intention to convert the ruble into a convertible currency that would be used for the trade.

Russia has recently swapped some of its dollar reserves for euros.

Together Iran, Venezuela and Russia corner some 25 percent of the export market in oil. If the three countries do away with the petrodollar, this could seriously buffet the US currency, forcing up interest rates, increasing the cost of imports in the US and contributing to an inflationary economy or a recession.

William Clark writing in the Energy Bulletin says, “What we are witnessing is a battle for oil currency supremacy. If Iran’s oil bourse becomes a successful alternative for international oil trades, it would challenge the hegemony currently enjoyed by the financial centers in both London (IPE) and New York (NYMEX) . . ."

At the same time, nations in this region have been exchanging percentages of their dollar reserves for other currencies.

In March, following the Dubai Ports World debacle, the UAE Central Bank said it was considering converting 10 percent of its dollar reserves to euros. Kuwait and Qatar have hinted that they might do the same.

The Commercial Bank of Syria has exchanged all its dollar devise for euros, following a call from Washington urging US banks to cease acting as correspondents for Syrian financial institutions, ostensibly because of money-laundering concerns.

Last month, Sweden cut the dollar share of its $21 billion foreign reserves from 37 percent down to 20 percent, causing the dollar to tumble almost 2 percent in one week.

Sweden’s central bank said the switch to euros was an effort to stabilize its foreign currency reserves and reduce volatile currencies.

Iran, Venezuela and Russia are hardly on warm terms with the US government and their proposed flight from dollars is thought to be partially if not wholly politically motivated. However, if the dollar value plunges as a result, then central banks around the world will be left with devalued reserves, and may have to start switching as well. Continue reading...

Saturday, May 20, 2006

Skype and Freedom

Skype, the free and easy to use internet telephone, has announced that calling to non-Skype numbers (called SkypeOut) will also be free (for the US and Canada) until the end of 2006. This is amazing news. Download Skype from www.skype.com . You’ll need a headset with a microphone (cost about $30) to prevent feedback and give you excellent quality. Then start calling with your free long-distance internet phone. Whoopeeee!

My question: Are these calls also being monitored by the NSA? I don’t think so.

Another workaround: instead of using email, which is searched automatically by NSA for keywords, use your mic and headset to record mp3 (audio) files and attach these files to an email. They would have to be played to be searched for keywords. I don’t think the NSA has gotten to that yet either.

Google Echelon for your own edification. And please comment if you have any additional information.

Friday, May 19, 2006

Gold and Silver: Dips and Corrections

This is some of the best advice I've seen. If you are not in the market, buy now. If you are already in, read on...

Corrections

By: Jason Hommel, Silver Stock Report

My portfolio of mostly silver stocks is down about 17% from its high last week on May 11th. And in that time, gold has dropped back from a high of about $720-$725 down to a high of $719 earlier today, and loads of so-called analysts are calling for a correction, or trying to describe this week's price action as a correction. Sigh. I've not been doing this for very long, only about 7 years now, and I've seen my own portfolio of silver stocks lose just about 50% three times now, on the way up to over 1000% gains. I never use stop losses--that's just a way to get kicked out at the bottom--which is a fool's game. I stay fully invested in the sector, rarely trade more than 10% of my portfolio in a month, and keep my cash to generally between 1-5% of my overall holdings. So, be patient, take heart, and stick with it; especially you newer investors.

Continue reading

Monday, May 15, 2006

NSA Phone Phlap

See also CALEA.

Sunday, May 14, 2006

Dollar in Meltdown Mode - IMF to Act?

Something big is coming this week. Maybe a whole bunch of big things: Rove indicted, dollar plummets, gold, silver, gold and silver, Iran, full NSA Echelon exposed, Bush's head explodes, who knows. But I feel it in my bones. Be alert - the world needs more lerts.

By way of GATA:

We are in meltdown mode,' said David Brown, chief European economist at Bear Stearns. 'It's all being whipped up into a bit of a selling frenzy. The dollar has a massive portfolio of negatives against it: it's the long-term problems of the trade deficit, and the government's budget deficit.'

Bloom warned that 'phase two' of a sell-off would cause turmoil in the equity markets, as on Friday, when both the Dow Jones and FTSE saw sharp losses. 'I'm expecting an increase in volatility and uncertainty across the board,' he said.

Brown added that the dollar's woes were likely to be exacerbated by central banks shifting their reserves towards other currencies, including the euro. 'Asian central banks have been buying fistfuls of dollars as the flipside of their massive current account surpluses. They're long dollars.'

He added that with the US current account deficit with the rest of the world worth 7 per cent (ed. note: 5% in any other country would be melting point) of its GDP in 2005, the White House and the Federal Reserve would probably be happy to watch the dollar decline. 'I don't think Washington's going to be concerned,' he said.

How High Will Gold and Silver Go?

For example, read The Gold Price – A “Spike” Or Something Else? By: Julian D. W. Phillips, Gold Forecaster for extensive coverage of the question.

And then listen to this interview.

One of my main points is to compare the 1980 "spike" at $850 to today's $715 for gold. Remember, you have to adjust for the shrinking dollar.

From another analysis:

"Now let’s take a look at where we are with gold and its previous historic high. The high reached in gold was $850 an ounce seen in January 1980. Adjusted for inflation, that would correspond to $2088.90 for an ounce of gold today!

Gold in 1980 $850.00

In 2006 Dollars $2088.90

Let’s look at it from a reverse perspective. The recent (05/11/06) price of gold is $715.10 an ounce, which would correspond to $290.98 an ounce in 1980 adjusted dollars, nearly 66% below its previous peak.

Gold on 05/11/06 $715.10

In 1980 Dollars $290.98

If you listen to the interview, you'll might want to follow the advice given there... JUMP IN WITH BOTH FEET!!

Saturday, May 13, 2006

Cheney Retires for "Health Reasons".

Oh wait, I'm getting ahead of myself. That hasn't happened - yet. What has happened is this report by Reuters that Fitzpatrick is going after Dick (Stentman) Cheney. Cheney's recent inability to stay awake may be related to the hardening of the arteries in his brain. That's not a joke. Really, see for yourself.

Thursday, May 11, 2006

SLV, GLD, CEF or Physical Possession

Ok, you have finally started paying attention to the rising price of gold and silver. You didn’t listen (or if you did, please leave me a comment) a year ago when I was gently suggesting that you might consider these archaic metals as investment opportunities. Now your TV is telling you that gold and silver are hot. You are wondering if you have missed the boat.

My answer: No, not yet. You missed the first boat, but more are leaving daily. There is still time. But what should you do?

Before I get to that, let me make my usual disclaimer: I am not a financial advisor. I have no special expertise. But I have spent the last two years reading what the experts were saying and researching investment opportunities they have suggested. You can search this site for references to gold and silver to review what I’ve reported. And, most importantly, I have followed my own advice and made money. You, of course, should do your own research and due diligence before you make any investment. I’m just reporting what I’ve found and what I’ve done. Perhaps you can benefit from reviewing this information.

I am not going to document everything I say in these articles. You know how to use Google.

First, understand the difference between money and currency. Gold and silver have served as real money for thousands of years. Currency is the paper we currently use. In the past, our currency has been based on gold and/or silver (as mandated in our Consitution). That is no longer true. Our paper is “fiat” currency, based on nothing more than belief. Its value is determined by 1) how many dollars are in existence, and 2) how much the world believes that the US of A is the best place to invest.

Currently, #1 is going way up, and #2 is going way down. The result is that the value of the dollar is decreasing, and we call this inflation.

Second, you should understand that all of the government data; CPI, inflation rate, employment rate, jobless claims, etc. is juiced data. All of the formulae from which these numbers are derived have been tinkered with by the government to the point that their relationship to reality is severely strained. We are currently being told that the inflation rate is around 3%. Real-world estimates are closer to 10%.

Sooo…the price of everything isn’t really going up as it seems, your dollars are just getting littler. Gold, silver, copper, platinum, palladium, and all other commodities seem to be going up in price because of these little dollars. To counter this effect, you must buy something that it not losing its value with your shrinking dollars. Real estate used to be a hedge against inflation, but it has been jacked too high at this point to be of use right now. (Unless you can sell it and convert the dollars.)

Another choice is to buy gold and/or silver. This is fairly easy to do these days. The popular choices are electronic trading funds (ETF), gold mining shares, CEF (a Canadian gold and silver holding company), or actual bullion (coins or bars).

Two ETFs are GLD (share price fixed at 1/10 an ounce of gold) and the newly-minted SLV (share price fixed at 10 ouces of silver). I've owned neither. I've heard it said that they are "not for the little investor". I don't see why.

I do not buy gold or silver mining company shares because there are too many confounding variables; are they hedged, do they have good management, are they located in dangerous countries, subject to dangerous environmental concerns, etc. You can make a lot of money here when junior companies are bought up by larger companies, but you have to be very knowledgeable, which I am not.

CEF is a Canadian company that baby-sits gold and silver. They seem tightly regulated. Sometimes you can see that the price of CEF lags the action in GLD and SLV.

Open yourself an online stock trading account (I use eTrade), transfer some money from your home bank account, and buy some shares. You’ll learn how to keep track of things, so you can buy and sell when it is advantageous to you. Or just leave it there, and don’t worry about it for a while.

Unfortunately you can't just forget about it, because if the dollar really crashes, as many predict it will, you will want to cash out of your stock account and convert to physical gold or silver. If you wait too long there may not be much available at a reasonable price.

Which brings us to the end game, physical gold or silver. There are many considerations but here are a few.

Gold coins (Eagles, Krugerrands, and Maple Leafs) are called bullion. The difference in price disappears when you sell as does the condition (mint or not), so buy the cheapest. Gold coins are a very compact medium for value, easily stored and protected. Today 14 one ounce coins are worth about $10,000.

In silver this would be about 577 coins, much bulkier and harder to store. But silver is up 61% this year compared to gold’s increase of 36%. Some of both?

There are other forms of physical to be considered: junk silver (1964 and older silver US coins), rounds (like coins but not stamped), and bars.

They are all really cool. The form they are in might become important if you were to actually use them as a medium of exchange.

Next article: How High Will They Go?