Saturday, December 31, 2005

2006 - The Year of the Tipping Point

That tsunami, the collapse of the US dollar, is going to occur this year (2006).

How this will affect you and yours depends upon actions you take now. We are already in the process, but the acceleration will leave you breathless (but hopefully not lifeless) once it starts. You may not be able to react quickly enough in just a matter of months.

If you think I might have a 10% chance of being correct, wouldn’t it be prudent to at least read some of what I have read to bring me to this conclusion?

If you are a regular reader, you have already read some of the 12 "Continuing Cracks in the Dollar" postings on this blog. The following post brings us up to date, and makes clear that March of 2006, when Iran commits the same act which caused us to attack Iraq, will mark the beginning of the end for the USD. Read this article twice if you have to, but please read it. Your economic health may depend on it.

Petrodollar Warfare: Dollars, Euros and the Upcoming Iranian Oil Bourse

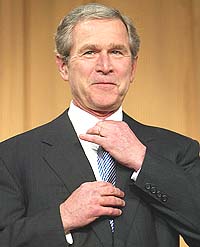

"This notion that the United States is getting ready to attack Iran is simply ridiculous...Having said that, all options are on the table."

-- President George W. Bush, February 2005

By William R. Clark 08/08/05

Contemporary warfare has traditionally involved underlying conflicts regarding economics and resources. Today these intertwined conflicts also involve international currencies, and thus increased complexity. Current geopolitical tensions between the United States and Iran extend beyond the publicly stated concerns regarding Iran's nuclear intentions, and likely include a proposed Iranian "petroeuro" system for oil trade. Similar to the Iraq war, military operations against Iran relate to the macroeconomics of 'petrodollar recycling' and the unpublicized but real challenge to U.S. dollar supremacy from the euro as an alternative oil transaction currency.

It is now obvious the invasion of Iraq had less to do with any threat from Saddam's long-gone WMD program and certainly less to do to do with fighting International terrorism than it has to do with gaining strategic control over Iraq's hydrocarbon reserves and in doing so maintain the U.S. dollar as the monopoly currency for the critical international oil market. Throughout 2004 information provided by former administration insiders revealed the Bush/Cheney administration entered into office with the intention of toppling Saddam.[1][2] Candidly stated, 'Operation Iraqi Freedom' was a war designed to install a pro-U.S. government in Iraq, establish multiple U.S military bases before the onset of global Peak Oil, and to reconvert Iraq back to petrodollars while hoping to thwart further OPEC momentum towards the euro as an alternative oil transaction currency ( i.e. "petroeuro").[3] However, subsequent geopolitical events have exposed neoconservative strategy as fundamentally flawed, with Iran moving towards a petroeuro system for international oil trades, while Russia evaluates this option with the European Union.

In 2003 the global community witnessed a combination of petrodollar warfare and oil depletion warfare. The majority of the world's governments – especially the E.U., Russia and China – were not amused – and neither are the U.S. soldiers who are currently stationed inside a hostile Iraq. In 2002 I wrote an award-winning online essay that asserted Saddam Hussein sealed his fate when he announced on September 2000 that Iraq was no longer going to accept dollars for oil being sold under the UN's Oil-for-Food program, and decided to switch to the euro as Iraq's oil export currency.[4] Indeed, my original pre-war hypothesis was validated in a Financial Times article dated June 5, 2003, which confirmed Iraqi oil sales returning to the international markets were once again denominated in U.S. dollars – not euros.

The tender, for which bids are due by June 10, switches the transaction back to dollars -- the international currency of oil sales - despite the greenback's recent fall in value. Saddam Hussein in 2000 insisted Iraq's oil be sold for euros, a political move, but one that improved Iraq's recent earnings thanks to the rise in the value of the euro against the dollar. [5]

The Bush administration implemented this currency transition despite the adverse impact on profits from Iraqi's export oil sales.[6] (In mid-2003 the euro was valued approx. 13% higher than the dollar, and thus significantly impacted the ability of future oil proceeds to rebuild Iraq's infrastructure). Not surprisingly, this detail has never been mentioned in the five U.S. major media conglomerates who control 90% of information flow in the U.S., but confirmation of this vital fact provides insight into one of the crucial – yet overlooked – rationales for 2003 the Iraq war.

Concerning Iran, recent articles have revealed active Pentagon planning for operations against its suspected nuclear facilities. While the publicly stated reasons for any such overt action will be premised as a consequence of Iran's nuclear ambitions, there are again unspoken macroeconomic drivers underlying the second stage of petrodollar warfare – Iran's upcoming oil bourse. (The word bourse refers to a stock exchange for securities trading, and is derived from the French stock exchange in Paris, the Federation Internationale des Bourses de Valeurs.)

In essence, Iran is about to commit a far greater "offense" than Saddam Hussein's conversion to the euro for Iraq's oil exports in the fall of 2000. Beginning in March 2006, the Tehran government has plans to begin competing with New York's NYMEX and London's IPE with respect to international oil trades – using a euro-based international oil-trading mechanism.[7] The proposed Iranian oil bourse signifies that without some sort of US intervention, the euro is going to establish a firm foothold in the international oil trade. Given U.S. debt levels and the stated neoconservative project of U.S. global domination, Tehran's objective constitutes an obvious encroachment on dollar supremacy in the crucial international oil market.

From the autumn of 2004 through August 2005, numerous leaks by concerned Pentagon employees have revealed that the neoconservatives in Washington are quietly – but actively – planning for a possible attack against Iran. In September 2004 Newsweek reported:

Deep in the Pentagon, admirals and generals are updating plans for possible U.S. military action in Syria and Iran. The Defense Department unit responsible for military planning for the two troublesome countries is "busier than ever," an administration official says. Some Bush advisers characterize the work as merely an effort to revise routine plans the Pentagon maintains for all contingencies in light of the Iraq war. More skittish bureaucrats say the updates are accompanied by a revived campaign by administration conservatives and neocons for more hard-line U.S. policies toward the countries…'

…administration hawks are pinning their hopes on regime change in Tehran – by covert means, preferably, but by force of arms if necessary. Papers on the idea have circulated inside the administration, mostly labeled "draft" or "working draft" to evade congressional subpoena powers and the Freedom of Information Act. Informed sources say the memos echo the administration's abortive Iraq strategy: oust the existing regime, swiftly install a pro-U.S. government in its place (extracting the new regime's promise to renounce any nuclear ambitions) and get out. This daredevil scheme horrifies U.S. military leaders, and there's no evidence that it has won any backers at the cabinet level. [8]

Indeed, there are good reasons for U.S. military commanders to be 'horrified' at the prospects of attacking Iran. In the December 2004 issue of the Atlantic Monthly, James Fallows reported that numerous high-level war-gaming sessions had recently been completed by Sam Gardiner, a retired Air Force colonel who has run war games at the National War College for the past two decades.[9] Col. Gardiner summarized the outcome of these war games with this statement, "After all this effort, I am left with two simple sentences for policymakers: You have no military solution for the issues of Iran. And you have to make diplomacy work." Despite Col. Gardiner's warnings, yet another story appeared in early 2005 that reiterated this administration's intentions towards Iran. Investigative reporter Seymour Hersh's article in The New Yorker included interviews with various high-level U.S. intelligence sources. Hersh wrote:

In my interviews [with former high-level intelligence officials], I was repeatedly told that the next strategic target was Iran. Everyone is saying, 'You can't be serious about targeting Iran. Look at Iraq,' the former [CIA] intelligence official told me. But the [Bush administration officials] say, 'We've got some lessons learned – not militarily, but how we did it politically. We're not going to rely on agency pissants.' No loose ends, and that's why the C.I.A. is out of there. [10]

The most recent, and by far the most troubling, was an article in The American Conservative by intelligence analyst Philip Giraldi. His article, "In Case of Emergency, Nuke Iran," suggested the resurrection of active U.S. military planning against Iran – but with the shocking disclosure that in the event of another 9/11-type terrorist attack on U.S. soil, Vice President Dick Cheney's office wants the Pentagon to be prepared to launch a potential tactical nuclear attack on Iran – even if the Iranian government was not involved with any such terrorist attack against the U.S.:

The Pentagon, acting under instructions from Vice President Dick Cheney's office, has tasked the United States Strategic Command (STRATCOM) with drawing up a contingency plan to be employed in response to another 9/11-type terrorist attack on the United States. The plan includes a large-scale air assault on Iran employing both conventional and tactical nuclear weapons. Within Iran there are more than 450 major strategic targets, including numerous suspected nuclear-weapons-program development sites. Many of the targets are hardened or are deep underground and could not be taken out by conventional weapons, hence the nuclear option. As in the case of Iraq, the response is not conditional on Iran actually being involved in the act of terrorism directed against the United States. Several senior Air Force officers involved in the planning are reportedly appalled at the implications of what they are doing – that Iran is being set up for an unprovoked nuclear attack – but no one is prepared to damage his career by posing any objections. [11]

Why would the Vice President instruct the U.S. military to prepare plans for what could likely be an unprovoked nuclear attack against Iran? Setting aside the grave moral implications for a moment, it is remarkable to note that during the same week this "nuke Iran" article appeared, the Washington Post reported that the most recent National Intelligence Estimate (NIE) of Iran's nuclear program revealed that, "Iran is about a decade away from manufacturing the key ingredient for a nuclear weapon, roughly doubling the previous estimate of five years."[12] This article carefully noted this assessment was a "consensus among U.S. intelligence agencies, [and in] contrast with forceful public statements by the White House." The question remains, Why would the Vice President advocate a possible tactical nuclear attack against Iran in the event of another major terrorist attack against the U.S. – even if Tehran was innocent of involvement?

Perhaps one of the answers relates to the same obfuscated reasons why the U.S. launched an unprovoked invasion to topple the Iraq government – macroeconomics and the desperate desire to maintain U.S. economic supremacy. In essence, petrodollar hegemony is eroding, which will ultimately force the U.S. to significantly change its current tax, debt, trade, and energy policies, all of which are severely unbalanced. World oil production is reportedly "flat out," and yet the neoconservatives are apparently willing to undertake huge strategic and tactical risks in the Persian Gulf. Why? Quite simply – their stated goal is U.S. global domination – at any cost.

To date, one of the more difficult technical obstacles concerning a euro-based oil transaction trading system is the lack of a euro-denominated oil pricing standard, or oil 'marker' as it is referred to in the industry. The three current oil markers are U.S. dollar denominated, which include the West Texas Intermediate crude (WTI), Norway Brent crude, and the UAE Dubai crude. However, since the summer of 2003 Iran has required payments in the euro currency for its European and Asian/ACU exports – although the oil pricing these trades was still denominated in the dollar.[13]

Therefore a potentially significant news story was reported in June 2004 announcing Iran's intentions to create of an Iranian oil bourse. This announcement portended competition would arise between the Iranian oil bourse and London's International Petroleum Exchange (IPE), as well as the New York Mercantile Exchange (NYMEX). [Both the IPE and NYMEX are owned by U.S. consortium, and operated by an Atlanta-based corporation, IntercontinentalExchange, Inc.]

The macroeconomic implications of a successful Iranian bourse are noteworthy. Considering that in mid-2003 Iran switched its oil payments from E.U. and ACU customers to the euro, and thus it is logical to assume the proposed Iranian bourse will usher in a fourth crude oil marker – denominated in the euro currency. This event would remove the main technical obstacle for a broad-based petroeuro system for international oil trades. From a purely economic and monetary perspective, a petroeuro system is a logical development given that the European Union imports more oil from OPEC producers than does the U.S., and the E.U. accounted for 45% of exports sold to the Middle East. (Following the May 2004 enlargement, this percentage likely increased).

Despite the complete absence of coverage from the five U.S. corporate media conglomerates, these foreign news stories suggest one of the Federal Reserve's nightmares may begin to unfold in the spring of 2006, when it appears that international buyers will have a choice of buying a barrel of oil for $60 dollars on the NYMEX and IPE - or purchase a barrel of oil for €45 - €50 euros via the Iranian Bourse. This assumes the euro maintains its current 20-25% appreciated value relative to the dollar – and assumes that some sort of US "intervention" is not launched against Iran. The upcoming bourse will introduce petrodollar versus petroeuro currency hedging, and fundamentally new dynamics to the biggest market in the world - global oil and gas trades. In essence, the U.S. will no longer be able to effortlessly expand credit via U.S. Treasury bills, and the dollar's demand/liquidity value will fall.

It is unclear at the time of writing if this project will be successful, or could it prompt overt or covert U.S. interventions – thereby signaling the second phase of petrodollar warfare in the Middle East. Regardless of the potential U.S. response to an Iranian petroeuro system, the emergence of an oil exchange market in the Middle East is not entirely surprising given the domestic peaking and decline of oil exports in the U.S. and U.K, in comparison to the remaining oil reserves in Iran, Iraq and Saudi Arabia. What we are witnessing is a battle for oil currency supremacy. If Iran's oil bourse becomes a successful alternative for international oil trades, it would challenge the hegemony currently enjoyed by the financial centers in both London (IPE) and New York (NYMEX), a factor not overlooked in the following (UK) Guardian article:

Iran is to launch an oil trading market for Middle East and Opec producers that could threaten the supremacy of London's International Petroleum Exchange.

…Some industry experts have warned the Iranians and other OPEC producers that western exchanges are controlled by big financial and oil corporations, which have a vested interest in market volatility. [emphasis added]

The IPE, bought in 2001 by a consortium that includes BP, Goldman Sachs and Morgan Stanley, was unwilling to discuss the Iranian move yesterday. "We would not have any comment to make on it at this stage," said an IPE spokeswoman. [14]

During an important speech in April 2002, Mr. Javad Yarjani, an OPEC executive, described three pivotal events that would facilitate an OPEC transition to euros.[15] He stated this would be based on (1) if and when Norway's Brent crude is re-dominated in euros, (2) if and when the U.K. adopts the euro, and (3) whether or not the euro gains parity valuation relative to the dollar, and the EU's proposed expansion plans were successful. Notably, both of the later two criteria have transpired: the euro's valuation has been above the dollar since late 2002, and the euro-based E.U. enlarged in May 2004 from 12 to 22 countries. Despite recent "no" votes by French and Dutch voters regarding a common E.U. Constitution, from a macroeconomic perspective, these domestic disagreements do no reduce the euro currency's trajectory in the global financial markets – and from Russia and OPEC's perspective – do not adversely impact momentum towards a petroeuro. In the meantime, the U.K. remains uncomfortably juxtaposed between the financial interests of the U.S. banking nexus (New York/Washington) and the E.U. financial centers (Paris/Frankfurt).

The most recent news reports indicate the oil bourse will start trading on March 20, 2006, coinciding with the Iranian New Year.[16] The implementation of the proposed Iranian oil Bourse – if successful in utilizing the euro as its oil transaction currency standard – essentially negates the previous two criteria as described by Mr. Yarjani regarding the solidification of a petroeuro system for international oil trades. It should also be noted that throughout 2003-2004 both Russia and China significantly increased their central bank holdings of the euro, which appears to be a coordinated move to facilitate the anticipated ascendance of the euro as a second World Reserve Currency. [17] [18] China's announcement in July 2005 that is was re-valuing the yuan/RNB was not nearly as important as its decision to divorce itself form a U.S. dollar peg by moving towards a "basket of currencies" – likely to include the yen, euro, and dollar.[19] Additionally, the Chinese re-valuation immediately lowered their monthly imported "oil bill" by 2%, given that oil trades are still priced in dollars, but it is unclear how much longer this monopoly arrangement will last.

Furthermore, the geopolitical stakes for the Bush administration were raised dramatically on October 28, 2004, when Iran and China signed a huge oil and gas trade agreement (valued between $70 - $100 billion dollars.) [20] It should also be noted that China currently receives 13% of its oil imports from Iran. In the aftermath of the Iraq invasion, the U.S.-administered Coalition Provisional Authority (CPA) nullified previous oil lease contracts from 1997-2002 that France, Russia, China and other nations had established under the Saddam regime. The nullification of these contracts worth a reported $1.1 trillion created political tensions between the U.S and the European Union, Russia and China. The Chinese government may fear the same fate awaits their oil investments in Iran if the U.S. were able to attack and topple the Tehran government. Despite U.S. desires to enforce petrodollar hegemony, the geopolitical risks of an attack on Iran's nuclear facilities would surely create a serious crisis between Washington and Beijing.

It is increasingly clear that a confrontation and possible war with Iran may transpire during the second Bush term. Clearly, there are numerous tactical risks regarding neoconservative strategy towards Iran. First, unlike Iraq, Iran has a robust military capability. Secondly, a repeat of any "Shock and Awe" tactics is not advisable given that Iran has installed sophisticated anti-ship missiles on the Island of Abu Musa, and therefore controls the critical Strait of Hormuz – where all of the Persian Gulf bound oil tankers must pass.[22] The immediate question for Americans? Will the neoconservatives attempt to intervene covertly and/or overtly in Iran during 2005 or 2006 in a desperate effort to prevent the initiation of euro-denominated international crude oil sales? Commentators in India are quite correct in their assessment that a U.S. intervention in Iran is likely to prove disastrous for the United States, making matters much worse regarding international terrorism, not to the mention potential effects on the U.S. economy.

…If it [ U.S.] intervenes again, it is absolutely certain it will not be able to improve the situation…There is a better way, as the constructive engagement of Libya's Colonel Muammar Gaddafi has shown...Iran is obviously a more complex case than Libya, because power resides in the clergy, and Iran has not been entirely transparent about its nuclear programme, but the sensible way is to take it gently, and nudge it to moderation. Regime change will only worsen global Islamist terror, and in any case, Saudi Arabia is a fitter case for democratic intervention, if at all. [21]

A successful Iranian bourse will solidify the petroeuro as an alternative oil transaction currency, and thereby end the petrodollar's hegemonic status as the monopoly oil currency. Therefore, a graduated approach is needed to avoid precipitous U.S. economic dislocations. Multilateral compromise with the EU and OPEC regarding oil currency is certainly preferable to an 'Operation Iranian Freedom,' or perhaps another CIA-backed coup such as operation "Ajax" from 1953. Despite the impressive power of the U.S. military, and the ability of our intelligence agencies to facilitate 'interventions,' it would be perilous and possibly ruinous for the U.S. to intervene in Iran given the dire situation in Iraq. The Monterey Institute of International Studies warned of the possible consequences of a preemptive attack on Iran's nuclear facilities:

An attack on Iranian nuclear facilities…could have various adverse effects on U.S. interests in the Middle East and the world. Most important, in the absence of evidence of an Iranian illegal nuclear program, an attack on Iran's nuclear facilities by the U.S. or Israel would be likely to strengthen Iran's international stature and reduce the threat of international sanctions against Iran. [23]

Synopsis:

It is not yet clear if a U.S. military expedition will occur in a desperate attempt to maintain petrodollar supremacy. Regardless of the recent National Intelligence Estimate that down-played Iran's potential nuclear weapons program, it appears increasingly likely the Bush administration may use the specter of nuclear weapon proliferation as a pretext for an intervention, similar to the fears invoked in the previous WMD campaign regarding Iraq. If recent stories are correct regarding Cheney's plan to possibly use a another 9/11 terrorist attack as the pretext or casus belli for a U.S. aerial attack against Iran, this would confirm the Bush administration is prepared to undertake a desperate military strategy to thwart Iran's nuclear ambitions, while simultaneously attempting to prevent the Iranian oil Bourse from initiating a euro-based system for oil trades.

However, as members of the U.N. Security Council; China, Russia and E.U. nations such as France and Germany would likely veto any U.S.-sponsored U.N. Security Resolution calling the use of force without solid proof of Iranian culpability in a major terrorist attack. A unilateral U.S. military strike on Iran would isolate the U.S. government in the eyes of the world community, and it is conceivable that such an overt action could provoke other industrialized nations to strategically abandon the dollar en masse. Indeed, such an event would create pressure for OPEC or Russia to move towards a petroeuro system in an effort to cripple the U.S. economy and its global military presence. I refer to this in my book as the "rogue nation hypothesis."

While central bankers throughout the world community would be extremely reluctant to 'dump the dollar,' the reasons for any such drastic reaction are likely straightforward from their perspective – the global community is dependent on the oil and gas energy supplies found in the Persian Gulf. Hence, industrialized nations would likely move in tandem on the currency exchange markets in an effort to thwart the neoconservatives from pursuing their desperate strategy of dominating the world's largest hydrocarbon energy supply. Any such efforts that resulted in a dollar currency crisis would be undertaken – not to cripple the U.S. dollar and economy as punishment towards the American people per se – but rather to thwart further unilateral warfare and its potentially destructive effects on the critical oil production and shipping infrastructure in the Persian Gulf. Barring a U.S. attack, it appears imminent that Iran's euro-denominated oil bourse will open in March 2006. Logically, the most appropriate U.S. strategy is compromise with the E.U. and OPEC towards a dual-currency system for international oil trades.

Of all the enemies to public liberty war is, perhaps, the most to be dreaded because it comprises and develops the germ of every other. War is the parent of armies; from these proceed debts and taxes...known instruments for bringing the many under the domination of the few…No nation could preserve its freedom in the midst of continual warfare.

-- James Madison, Political Observations, 1795

Footnotes:

[1]. Ron Suskind, The Price of Loyalty: George W. Bush, the White House, and the Education of Paul O' Neill, Simon & Schuster publishers (2004)

[2]. Richard A. Clarke, Against All Enemies: Inside America's War on Terror, Free Press (2004)

[3]. William Clark, "Revisited - The Real Reasons for the Upcoming War with Iraq: A Macroeconomic and Geostrategic Analysis of the Unspoken Truth," January 2003 (updated January 2004)

http://www.ratical.org/ratville/CAH/RRiraqWar.html

[4]. Peter Philips, Censored 2004, The Top 25 Censored News Stories, Seven Stories Press, (2003) General website for Project Censored: http://www.projectcensored.org/

Story #19: U.S. Dollar vs. the Euro: Another Reason for the Invasion of Iraq

http://www.projectcensored.org/publications/2004/19.html

[5]. Carol Hoyos and Kevin Morrison, "Iraq returns to the international oil market," Financial Times, June 5, 2003

[6]. Faisal Islam, "Iraq nets handsome profit by dumping dollar for euro," [UK] Guardian, February 16, 2003

http://observer.guardian.co.uk/iraq/story/0,12239,896344,00.html

[7]. "Oil bourse closer to reality," IranMania.com, December 28, 2004. Also see: "Iran oil bourse wins authorization," Tehran Times, July 26, 2005

[8]. "War-Gaming the Mullahs: The U.S. weighs the price of a pre-emptive strike," Newsweek, September 27 issue, 2004. http://www.msnbc.msn.com/id/6039135/site/newsweek/

[9]. James Fallows, 'Will Iran be Next?,' Atlantic Monthly, December 2004, pgs. 97 – 110

[10]. Seymour Hersh, "The Coming Wars," The New Yorker, January 24th – 31st issue, 2005, pgs. 40-47 Posted online January 17, 2005. Online: http://www.newyorker.com/fact/content/?050124fa_fact

[11]. Philip Giraldi, "In Case of Emergency, Nuke Iran," American Conservative, August 1, 2005

[12]. Dafina Linzer, "Iran Is Judged 10 Years From Nuclear Bomb U.S. Intelligence Review Contrasts With Administration Statements," Washington Post, August 2, 2005; Page A01

[13]. C. Shivkumar, "Iran offers oil to Asian union on easier terms," The Hindu Business Line (June 16, ` 2003). http://www.thehindubusinessline.com/bline/2003/06/17/stories/

2003061702380500.htm

[14]. Terry Macalister, "Iran takes on west's control of oil trading," The [UK] Guardian, June 16, 2004

http://www.guardian.co.uk/business/story/0,3604,1239644,00.html

[15]. "The Choice of Currency for the Denomination of the Oil Bill," Speech given by Javad Yarjani, Head of OPEC's Petroleum Market Analysis Dept, on The International Role of the Euro (Invited by the Spanish Minister of Economic Affairs during Spain's Presidency of the EU) (April 14, 2002, Oviedo, Spain)

http://www.opec.org/NewsInfo/Speeches/sp2002/spAraqueSpainApr14.htm

[16]. "Iran's oil bourse expects to start by early 2006," Reuters, October 5, 2004 http://www.iranoilgas.com

[17]. "Russia shifts to euro as foreign currency reserves soar," AFP, June 9, 2003

http://www.cdi.org/russia/johnson/7214-3.cfm

[18]. "China to diversify foreign exchange reserves," China Business Weekly, May 8, 2004

http://www.chinadaily.com.cn/english/doc/2004-05/08/content_328744.htm

[19]. Richard S. Appel, "The Repercussions from the Yuan's Revaluation," kitco.com, July 27, 2005

http://www.kitco.com/ind/appel/jul272005.html

[20]. China, Iran sign biggest oil & gas deal,' China Daily, October 31, 2004. Online: Online: http://www.chinadaily.com.cn/english/doc/2004-10/31/content_387140.htm

[21]. "Terror & regime change: Any US invasion of Iran will have terrible consequences," News Insight: Public Affairs Magazine, June 11, 2004 http://www.indiareacts.com/archivedebates/nat2.asp?recno=908&ctg=World

[22]. Analysis of Abu Musa Island, www.globalsecurity.org

http://www.globalsecurity.org/wmd/world/iran/abu-musa.htm

[23]. Sammy Salama and Karen Ruster, "A Preemptive Attack on Iran's Nuclear Facilities: Possible Consequences," Monterry Institute of International Studies, August 12, 2004 (updated September 9, 2004) http://cns.miis.edu/pubs/week/040812.htm

© 2005 William R. Clark

Thursday, December 22, 2005

In the Spirit of the Season

Wednesday, December 21, 2005

Bush Gets Jiggy With Echelon

Echelon

I guess it would be funny if it wasn't so important. All of the talking heads babbling about wire-tapping, skirting the FISA court, Bush eavesdropping and so on. Apparently the MSM hasn’t noticed that this has been going on for years in an international effort called Echelon conducted by NSA in conjunction with all of the English-speaking countries. Click on the title if you are unaware...

Oh, and by the way, be sure not to say that your friend “bombed” in the play last night, or you may find yourself unable to board an airplane in the future.

“Everything, all the time” ... from "Life in the Fastlane" by the Eagles

Monday, December 19, 2005

The 21st Century Nazis Are Here

"The Iraqi police Special Forces, Al-Hussein Brigades, came at dawn. There were around 20 pick ups full of them. They were hit on the highway very badly from a place behind the Yosfiya Water Project, east of the village. Tens of them were killed. Their cars were burnt. Some of them hid inside the village. The battle went on for 3 hours. In the end some of them managed to run away. In the afternoon, the same day, more forces returned back accompanied by the American troops and helicopters. They evacuated their dead, raided the houses, killed and arrested the men, humiliated the families, killed the cows and chickens, destroyed the yards, and set the village on fire.

“They dragged one of the men Abbass Oeid, more than 70 years, and beat him to death. Two other man, were arrested, Karim Motar, 50, and Riyadh Talab Jabr, 20. Their bodies were found three days later in Baghdad. They put police uniform on Karim’s body. Riyadh was naked. Both were savagely tortured, their bones, backs, and arms were smashed”.

“They believed that the village was colluding with the resistance”

.…

“I want the government to hear my question and answer me: why were we treated like this? The police brigades broke even the electricity converters, we do not have power for 40 days, of course water pumps do not operate and the plants are all dead. Our animals were killed, our women humiliated. They ask the women where did you hide the men, they grabbed the children from their hair and throw them to the ground. Riyadh’s mother was crying and begging them to leave her son; they hit her with the gun’s end, they smashed his head with a brick in front of her eyes, now she is dying. When his body was found it was skinned… Abbass was so old that he could not even walk, how he would be a terrorist!! He was beaten to death on the spot and his body was thrown in the drainage. When they searched the houses they did not find any indication that any of them had any thing to do with terrorism or weapons, so why? The government is working on turning every body against it. It is encouraging ordinary people to resist by treating them so savagely. They have no mercy. We have nothing left now, nothing.”

Saturday, December 17, 2005

Thank You Martin Garbus

by Martin Garbus from the Huffington Post

"Today, for two separate reasons, has been an incredible day in America.

First, the United States has legitimized torture and secondly, the President has admitted to an impeachable offense.

First, the media has been totally misled on the alleged Bush-McCain agreement on torture. McCain capitulated. It is not a defeat for Bush. It is a win for Cheney.

Torture is not banned or in any way impeded.

Under the compromise, anyone charged with torture can defend himself if a "reasonable" person could have concluded they were following a lawful order.

That defense "loophole" totally corrodes the ban. It is the CIA, or the torturing agency, who will decide what a "reasonable" person could have concluded. Can you imagine those agencies in the interrogation business torturing on their own in trying to decide what is reasonable or what is not? What is not "reasonable" if the interrogator (wrongfully or rightfully) believes he has a ticking-bomb situation? Will a CIA or military officer issue a narrow order if he knows his interrogator believes, in this case, torture will work?

The Bush-McCain torture compromise legitimizes torture. It is the first time that has happened in this country. Not in the two World Wars, Korea, the Cold War or Vietnam did the government ever seek or get the power this bill gives them.

The worst part of it is that most of the media missed it and got it wrong.

Secondly, the President in authorizing surveillance without seeking a court order has committed a crime. The Federal Communications Act criminalizes surveillance without a warrant. It is an impeachable offense. This was also totally missed by the media."

Sunday, December 11, 2005

Snake Oil Salesman

Primp

From George Mason University’s History News Network on George W. Bush by way of Ironwood

“He is blatantly a puppet for corporate interests, who care only about their own greed and have no sense of civic responsibility or community service.

He lies, constantly and often, seemingly without control, and he lied about his invasion into a sovereign country, again for corporate interests; many people have died and been maimed, and that has been lied about too.

He grandstands and mugs in a shameful manner, befitting a snake oil salesman, not a statesman.

He does not think, process, or speak well, and is emotionally immature due to, among other things, his lack of recovery from substance abuse. The term is "dry drunk".

He is an abject embarrassment/pariah overseas; the rest of the world hates him . . . . .

He is, by far, the most irresponsible, unethical, inexcusable occupant of our formerly highest office in the land that there has ever been.”

Friday, December 09, 2005

On the “Culture of Corruption” Event Horizon (Ain't It Grand!)

Duke's Lair

Duke's Lair

What would we do without the Internet News Gatherers?

You may have noticed the disgraced “Duke” Cunningham, bawling and slobbering on TV as he admitted taking $2.4 million in bribes and then resigning his House seat. But did you know that the same investigation is looking into an even bigger disclosure of as many as 20 Repuglicans (Henry Bonilla, Roy Brown, Rick Clayburgh, Duke Cunningham (of course!), John T. Doolittle, Maria Guadalupe Garcia, George W. Gekas, Lindsay Graham, Duncan Hunter, Darrell Issa, Samuel Johnson, Thaddeus G. McCotter, Constance Morella, Devin Nune, Steve Pearce, Bill Van de Weghe Jr., Jerry Weller.) who received payments from fake companies set up to receive Department of Defense contracts. This is going to be even bigger, and the Main Stream Media (MSM) hasn’t seemed to notice yet. Not to worry…the bloggers have got it.

http://cannonfire.blogspot.com/2005/12/deeper-into-wilkesmzm-scandals-updated.html

(This is a great blog with many breaking stories.)

Monday, December 05, 2005

Big Oil's Occupation of Iraq

Heather Wokusch

Mission accomplished: Big Oil's occupation of Iraq

Posted on Monday, December 05 @ 09:53:54 EST

"The Bush administration's covert plan to help energy companies steal Iraq's oil could be just weeks away from fruition, and the implications are staggering: continued price-gouging by Big Oil, increased subjugation of the Iraqi people, more US troops in Iraq, and a greater likelihood for a US invasion of Iran.

That's just for starters.The administration's challenge has been how to transfer Iraq's oil assets to private companies under the cloak of legitimacy, yet simultaneously keep prices inflated. But Bush & Co. and their Big Oil cronies might have found a simple yet devious solution: production sharing agreements (PSAs).

Here's how PSAs work. In return for investment in areas where fields are small and results are uncertain, governments occasionally grant oil companies sweetheart deals guaranteeing high profit margins and protection from exploration risks. The country officially retains ownership of its oil resources, but the contractual agreements are often so rigid and severe that in practical terms, it can be the equivalent of giving away the deed to the farm.

Since Iraq sits on the world's third largest oil reserves, the PSA model makes little sense in the first place; Iraq's fields are enormous and the exploration risks are accordingly miniscule, so direct national investment or more equitable forms of foreign investment would be in order. But as a comprehensive new report by the London-based advocacy group PLATFORM details, the PSA model "is on course to be adopted in Iraq, soon after the December elections, with no public debate and at enormous potential cost."

PLATFORM's "Crude Designs: The Rip-off of Iraq's Oil Wealth" points out that the proposed agreements (with US State Department origins) will prove a bonanza for oil companies but a disaster for the Iraqi people:- "At an oil price of $40 per barrel, Iraq stands to lose between $74 billion and $194 billion over the lifetime of the proposed contracts, from only the first 12 oilfields to be developed. These estimates, based on conservative assumptions, represent between two and seven times the current Iraqi government budget."

"Under the likely terms of the contracts, oil company rates of return from investing in Iraq would range from 42% to 162%, far in excess of usual industry minimum target of around 12% return on investment."

Of course, given the current political chaos, Iraqi citizens have little power over whether their politicians sign the proposed PSA agreements. That critical decision could be left to con-men like the former Interim Oil Minister Ahmad Chalabi, who recently met with no less than Cheney, Rumsfeld and Rice during his red-carpet visit to the White House. One can assume the topic of Iraq's proposed PSAs came up more than once. Chalabi's successor as Oil Minister, Ibrahim Mohammad Bahr al-Uloum, is expected to toe the corporate line, and Iraq's former Interim Prime Minister Iyad Allawi issued post-invasion guidelines stating: "The Iraqi authorities should not spend time negotiating the best possible deals with the oil companies; instead they should proceed quickly, agreeing to whatever terms the companies will accept, with a possibility of renegotiation later."

But PSAs are notoriously hard to renegotiate. According to PLATFORM, "under PSAs future Iraqi governments would be prevented from changing tax rates or introducing stricter laws or regulations relating to labour standards, workplace safety, community relations, environment or other issues." The Iraqi people would be locked into inflexible agreements spanning 25-40 years with disputes solved by corporate-friendly international arbitration tribunals, rather than by national courts.

Is that really the same thing as liberation? According to Greg Muttitt, co-author and lead researcher of the "Crude Designs" report, "for all the US administration's talk of creating a democracy in Iraq, in fact, their heavy pushing of PSAs stands to deprive Iraq of democratic control of its most important natural resource.

I would even go further: the USA, Britain and the oil companies seem to be taking advantage of the weakness of Iraq's new institutions of government, and of the terrible violence in the country, by pushing Iraq to sign deals in this weak state, whose terms would last for decades. The chances of Iraq getting a good deal for its people in these circumstances are minimal; the prospect of mega-profitable deals for multinational oil companies is fairly assured.

"Of course, ongoing oil exploration in Iraq by administration-friendly companies would require permanent US bases, a massive ongoing troop presence and billions more in taxpayer-dollar subsidies to sleazy outfits like Halliburton.

The implications of all of this for domestic oil prices is unclear. While neo-conservatives initially pushed for privatizing Iraq's oil reserves as a way of destroying OPEC (they wanted to boost production and flood world markets with cheap oil) the administration seems to have taken a more corporate-friendly stance. After all, the last thing oil executives want is to break OPEC's stranglehold on pricing, because keeping supply low has delivered record profits.

But the "National Strategy for Victory in Iraq" which Bush released this week as part of his pro-occupation PR blitz lists a surprising goal: "facilitating investment in Iraq's oil sector to increase production from the current 2.1 million barrels per day to more than 5 million per day." OPEC's quota for Iraq currently sits at around 4 million barrels per day, so the administration's goal is not only significantly higher, but (at "more than 5 million") a little too open-ended for the cartel's comfort. Could be that Bush & Co. want to have their cake and eat it too: tighten the screws on OPEC, yet continue to rip off consumers through elevated prices.

The whole PSA affair may also stoke the fires for a US invasion of Iran, which sits on oil reserves even greater than those of Iraq. Tehran already is on the administration's hit list, less for its nuclear aspirations than for its plans to open a euro-based international oil-trading market in early 2006. Iran's oil "bourse" would compete with the likes of New York's NYMEX and provide OPEC the opportunity to snub the greenback in favor of "petroeuros," a development the administration will avoid at all costs. So if the PSA model is adopted in Iraq, it would provide a clear precedent for implementing it in Iran too, and hand the administration another reason to start the next invasion."

Sunday, December 04, 2005

Astounding News Sells Out

If it gets to be too obnoxious, we'll take it down. If I make a lot of money, I'll let you know.

And while I'm at it, I'd like to thank you for reading this blog. While the numbers are miniscule by internet standards, it still feels good to pull up the world map of the last hundred visitors to AN and see that you are from all over the globe.

Curiously Pleasing

Saturday, December 03, 2005

Tech Note: Posting Video on the Internet

There is an easier way if you are willing to put up with a few unobtrusive ads on the side. It's called PutFile.com and you can try it out here with a short documentary I shot at the Anti-Bush Anti-War Demonstration in downtown Denver on November 29, 2005.

or

Click here to watch 'Denver-Demonstration-11-29-05'

Thursday, December 01, 2005

M3 to Disappear

In an administration determined to hide everything it can from public view, more secretive by far than the paranoid Nixon administration (see John Dean’s “Worse Than Watergate”), the Federal Reserve Board has quietly announced that it will no longer report M3 (the broadest measure of how much money is circulating in the U.S. at any one time). Not surprising given the ascension of Ben “Helicopter” Bernanke (so-called because he once said that the Fed could drop money from helicopters if needed to fight deflation) to Chairman of the Board.

Federal Reserve money supply report about to fall into the abyss

By Harlan Levy

Journal Inquirer, Manchester, Conn.

Wednesday, November 30, 2005

"In a little-noticed decision a few weeks ago, the Federal Reserve Board said it would stop publishing its weekly M3 money supply number as of next March, although it will continue to publish M0, M1, and M2.

M0is all coins and paper bills. M1 is M0 plus all checking accounts. M2 is M1 plus savings accounts, money market accounts, and certificates of deposit of less than $100,000. M3 is M2 plus all deposits, euro dollars, and repurchase agreements that are $100,000 and larger.

(A repurchase agreement is a short-term sale and subsequent repurchase of securities by a bank or other financial institution.)

M3 is the broadest measure of how much money is circulating in the U.S. at any one time. Unlike M2, M3 is the big stuff, the super-size deposits."M3 shows intervention and big money movements," Bill King says in The King Report.

But why should you care? Actually a lot of you should -- those who own stocks, and that amounts to about half of all U.S. households.

Now back to M3: I asked the Federal Reserve Board why it will stop publishing M3. "Our searching of the economic literature revealed that very few economists used that aggregate," the Fed responded, adding that "M3 does not appear to convey any additional information about economic activity that is not already embodied in the M2 aggregate. Further, the role of M3 in the policy process has diminished greatly over time. Consequently, the costs of collecting the data and publishing M3 now appear to outweigh the benefits.

"Some financial analysts disagree violently. "They know what's coming -- massive amounts of dollar creation to fund the worsening trade and federal government budget deficits," says James Turk in the Free Market Gold & Money Report. "There is only one reason for the Fed to conceal important monetary component information," The King Report says. It's "to cover up the truth about what the Fed, central banks, and the really big money are doing.

"The Fed, central banks, and other groups are informally known as the "Plunge Protection Team. "The reason the Fed will stop publishing weekly M3 totals, says financial analyst Robert McHugh Jr., is "so that the Plunge Protection Team can hide its market manipulative equity-buying activities." The PPT is poised to buy stocks and do it secretly, McHugh says, "to stop the higher-than-normal probability that the market could crash." McHugh surmised this in October, "because of the M3 numbers. We could see there was too much money being created. ... M3 was being pumped at three times the rate of growth" of the Gross Domestic Product.

Unlike M2, M3 includes items that are the most obvious signs of PPT market-buying transactions, McHugh says. "If they no longer report this item, folks like us who monitor the growth of M3 for clues as to when the PPT is likely to buy the market will have a harder time reporting that fact. Investors will be left more in the dark as to any secret rigging of the stock market."

A possible market crash is only one reason for secrecy, McHugh postulates. "Is the economy closer to the brink than anyone realizes? Or is it politically expedient to goose markets? Do the corporate elitists want the big payback for backing the powers that be and insist upon a rising market into year-end?" he asks.

"Do they see a catastrophe coming that will require hyperinflation to bail the U.S. out? Maybe."But the "master planners" do not believe in the forthright flow of information, McHugh says. "They believe that bad news cannot be handled by the flock, that confidence must be boosted at all costs, even if it entails manipulating the markets."

As the King Report puts it, "Am I suggesting there might be something of a nefarious nature going on here? I certainly am. "Making large stock purchases secretly, McHugh explains, can be enough to spark a rally, and when the buying gets heavy, the PPT can get out at a nice profit before the market resumes a slide, along with "their Wall Street friends who took the risk and bought with them early," leaving many investors high and dry.

It doesn't take much to realize that if investors like you and me don't know the reality of what's happening in the market and the economy because of deception, we can make some very bad decisions. The Fed, in its response, did not answer my question asking if the analysts' suspicions were true. But that doesn't mean we as citizens cannot ask those in Congress to find out the reason for the Fed's move. If it is suspicious, maybe it's possible to stop it. At least we should get a full answer."